A W2 Form is an important document that all employers use to record the annual wages, taxes charged, and other benefits earned by their workers. W2 Forms Filing Tips: by January 31, after the year you are filing, you can keep a copy for yourself and give one to employees and applicable tax agencies. Accutate W2 Forms are imparative so that workers do not face any problems; Errors can even fall back on you if the Form reveals that, though you didn’t, you withheld inadequate or excess taxes from their paychecks.

Have any of the workers taken advantage of the tax deferral of Social Security in 2020? If so, you will need to display this on the W2 Form and collect the taxes and file a revised form (W2c) in 2021. Later, we’ll talk about this more.

Consider working with AccuServe Payroll if you need assistance planning and filing your W2 reports. We will check and record payroll details for each of your employees so that you don’t have to and distribute the forms by the IRS deadline. For a free consultation, sign up.

Preparing W2 Forms for Employers

You can report payroll details for all workers during the calendar year, including payroll times, payment dates, gross profits, withheld taxes, and so on. You will need to complete all the earnings and tax details at the end of the year, so you can quickly add them to Form W2.

Tip: If you are using any form of program, even Microsoft Excel, or a payroll service, it is much easier to keep track of the sums you may need. Although you will use easy addition, keeping payroll details on pen and paper for months can render your year-end process unnecessarily cumbersome and result in payroll mistakes.

We recommend keeping the following on hand to complete W2 forms for each employee promptly:

- Blank copies of W2 Form: There are three versions you must order vs. use the online edition (the copy you submit to the Social Security Administration).

- Employee W-4 Forms: At the time of hiring, each employee should have submitted one of these. To support complete basic details such as full name, address, and social security number, you can use this.

- Payroll reports: You should print a payroll ledger or transaction report to capture all sums collected easily if you are using software.

Blank W2 Forms

The most updated version of Form W2 is still available on the IRS website. There is a new version released every year. Six copies of each W2 will be sent to you, three of which will be for your use, and the remainder to your employees.

Here’s a rundown of how to use those six copies of the W2 Form:

- Copy A: This will be filed with the Social Security Administration. Remember, you cannot print and upload this copy from the IRS site; it is for information purposes only and will not be scanned. You must buy directly from the IRS or risk paying a penalty.

- Copy 1: When taxes have been withheld, you can file this with the federal, local, or city tax agency.

- Copy B: For their federal tax return, the employee will file this copy.

- Copy C: This is for the workers to register for safekeeping.

- Copy 2: The employee may file this, if necessary, with their federal, county, or local income tax return.

- Copy D: To keep in your records, this is for you, the employer.

Who Should Receive Year-end W2 Forms?

It’s crucial to know who you need to give them when you begin to plan your year-end W2 Forms. All workers for whom you withheld payroll taxes should receive W2s, whether full- or part-time. You can only submit W2 Forms to anyone who received over \$600 in the year if you didn’t deduct payroll taxes from employee paychecks. However, independent contractors shouldn’t accept a W2 Form; form 1099 NEC would apply in this situation, even though they were paying more than $600 annually.

Aside from staff, the Social Security Administration and any state or local tax authorities that owe income tax would need to distribute copies. It is critical because, in addition to the overall amount of taxes received and charged on their salaries, they obtain reports on how much each employee earned during the year. Every agency will use the details you provided to decide whether or not the employee owes extra money and probably a penalty or a refund when workers start filing their taxes.

Distribute Form W2

You may want to start planning your W2 forms early, but it’s best to wait until you start filling them out after December 31. This will guarantee that you do not accidentally skip adding any payroll details to the study. By January 31 of the year following the year you are publishing, you can distribute all W2s. If this due date falls on a legally recognized Saturday, Sunday, or holiday, the next business day will be the deadline.

Note: You’ll have until Monday, February 1, 2021, to distribute Form W2 for the year 2020. And you will need to have all the W2 Forms sent by Monday, January 31, 2022, when the time comes to report for 2021.

Penalties for Not Submitting W2 Forms, Past Distribution Deadline

You will be subject to fines for not filing your employees’ year-end W2 Forms by the deadline, and the later you are, the more it can cost you.

If you are between one and 30 days late, the IRS will charge you $50 per W2. If you distribute any forms later than that, the penalty for those sent by August 1 will more than double to $110 per W2. It’s $270 per shape, after that. If the IRS determines that you are knowingly disregarding its deadlines, a charge of up to $550 per late W2.

How Employers Can Distribute W2 Forms

The good news is, when it comes to how you deliver W2 forms, you have choices that will make it easier for you to reach the deadline of January 31. Your payroll professional can prepare and submit the forms to each employee for you or fully automate the process if you have a payroll provider. For example, AccuServe Payroll provides secure employee portals and a mobile app where workers can obtain their W2s.

In the office, you can even fill out written forms yourself and hand them out. Also, the conventional approach still works-sending by mail. An email is an option; this is generally supported by payroll software.

Best Practices for Filing Form W2

You should follow some best practices to prevent being penalized or have to send a Corrected W-2 if you intend to complete W2 Forms manually for an employee.

- Double-check each Form against your payroll records for precision.

- Be sure the social security number of the employee matches the number on the W4 they sent.

- Double-check that the cumulative taxes you withhold and disclose in Boxes 4 and 6 on Social Security and Medicare make sense; the rates are 6.2 percent and 1.45 percent, respectively.

- Include only the employee’s gross wages in Box 1-no reimbursements, pre-tax incentives, or withholdings from payroll.

- Double-check that the codes in Box 12 are known. Data on uncollected taxes, deferral arrangements, workplace contributions, pre-tax benefits (such as health insurance), etc., may be required.

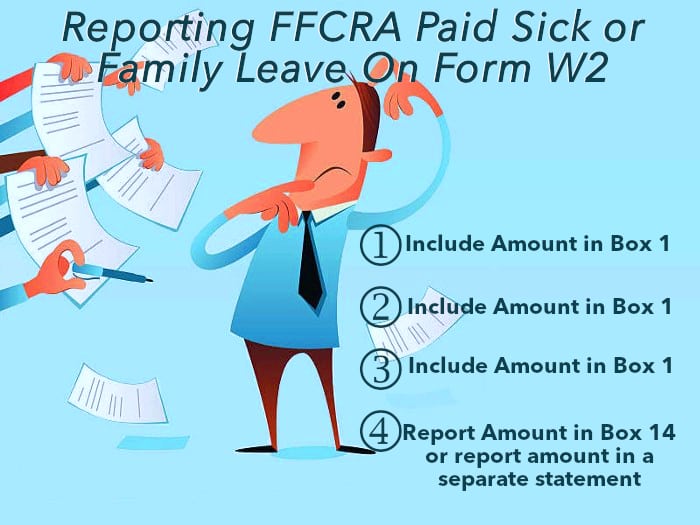

COVID-related Reporting on Form W2

You’d need to disclose this on Form W2 if any of your workers participated in the Social Security tax deferral that was allowed in 2020. There is no designated COVID reporting section; you would only need to ensure that you deduct the taxes on social security that you would have withheld if the deferral was not in effect from the amount recorded in Box 4, Withheld Taxes on Social Security.

You’ll have to request a Corrected W2 Form with the amounts represented when you receive the taxes in 2021.

W2 Type corrected. In the previously recorded columns, you can enter the amounts shown on the original W2 Form and the revised amounts that include previously deferred taxes in the Correct Details columns. Box 4 would be the only revised object in certain instances.

Make sure you understand what details Form W2 needs you to report and where; it can cost both time and money to get a Revised W2 completed due to errors. You’re going to have to reprint fresh copies, fill them out again, and probably you may even face fines.

Conclusion

For managing their year-end W2 Forms, all employers need a framework. Knowing where the forms are processed, how you intend to deliver them, and when it’s appropriate. It is also a key to success to have a good payroll process in place during the year because it regulates the data’s consistency and how convenient it would be to access it.

Partnering with a payroll business such as AccuServe will help save you time from having to complete your W2 Forms manually. You will also have peace of mind knowing that qualified payroll professionals take full responsibility for the correct way and promptly prepare and deliver your forms. To get started, submit a free quote.