Do you own a company?...

Read More

Paying family members on your payroll, what you should know!

For many self-employed and small businesses, working and employing family members provide a high level of comfort, familiarity, fun, and exceptional tax benefits.

That’s right: hiring your family members can bring significant tax benefits to your small business. Why is that? Are there any special rules restricting the employment of family members? In what situations are you exempt from standard tax regulations?

In this article, you’ll find answers to these and other questions about the tax implications of hiring family members. Let’s start with the first and most important question:

Can I add my family members to my small company’s payroll?

In short: yes.

There is no regulation against nepotism (also known as hiring family members and friends) in a private company. We are not talking about government positions or other public trust offices where family members can be both illegally and unethically.

Of course, when you hire family members to work in your organization, you must mentally distinguish between the two roles they play: a family member and a colleague.

Special rules regarding the employment of family members

In general, there are not many special rules to keep in mind when hiring a family member. In most cases, you should treat a family member like any other employee. For example, you must:

- Ask for a W-4 form from each family member and keep federal and state income taxes based on the systems you choose.

- Keep the appropriate amount of FICA taxes from the payment of each family member. In other words, you still (generally) have to deduct Social Security and Medicare taxes from your family wages. We’ll talk about exceptions later in this post.

- When calculating unemployment (FUTA) and employee pay taxes. The company must pay the employer portion of the family members.

- If your family members work overtime for you, you must pay them the same rate as other employees (1.5 times the rate after 40 hours of work).

There is an important issue to consider when hiring a child. The Federal Child Labor Act provides strict guidelines on when and how long children can work and what type of work they are allowed. For example, children under the age of 14 cannot work in any company, and children under the age of 18 cannot operate hazardous devices (as well as many types of power tools).

When do I have to pay taxes

As mentioned above, despite the employment of a family member, you may be required to pay all normal payroll taxes associated with hiring ordinary Joe off the street. For example, if your child works for a family business. You must pay all regular payroll taxes. The same applies to a partnership unless each partner is the child’s parent.

Similarly, if your business has a business or partnership, you will have to pay all regular taxes on your spouse if they work for your business.

What are the exceptions?

There are significant tax exemptions related to the employment of a potential family member:

- If your company is a sole proprietorship or limited company taxed as a partnership. You can hire your child and at the same time, avoid payroll tax. You can pay your child up to $ 6,300 a year without paying Medicare or Social Security taxes. (Of course, it’s important to make sure that your child’s work is age-appropriate and that he has significant work for your business)

- If another company is employing your spouse and is not in your partnership, the business owner does not have to maintain FUTA (unemployment tax) for the spouse.

- When a child’s company employs a parent, the child does not have to maintain FUTA tax for that parent.

After considering the tax breaks and special rules that apply to the employment of family members, you might decide that working with a child, spouse, or parent is not only a great way to keep your business in the family. but also a great way to reduce your tax burden.

Paying family members who do not work

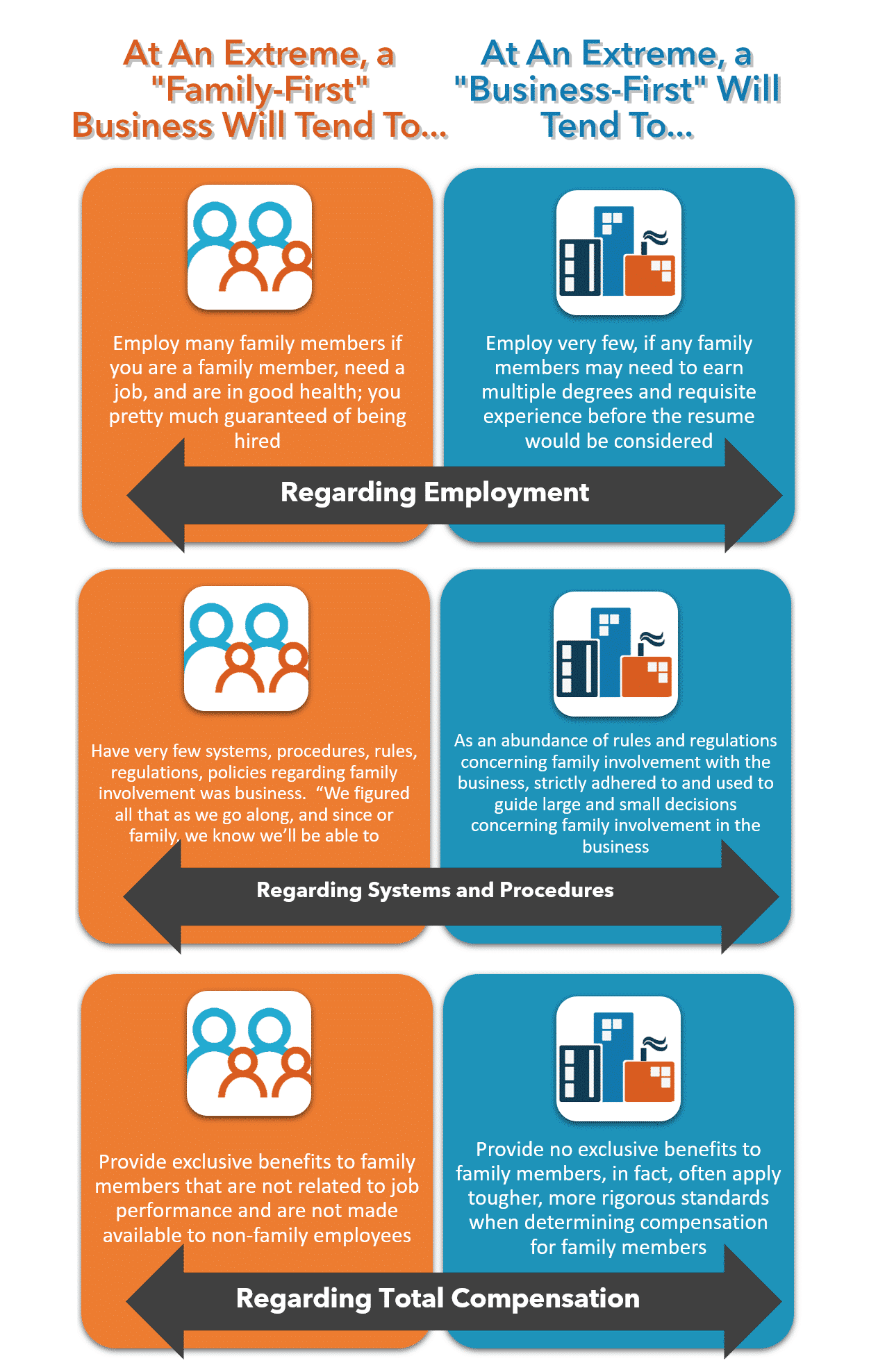

As is the case for many business practices and those of family firms, the guidance from business experts about paying nonworking family members is what you expect: “Don’t do it. Pay in exchange for work is a standard for every business. Pay for performance; if you do not work, you do not get paid. This is no different for a family member” And, for many family businesses, that is the best course of business when followed. There are sound reasons to follow this guidance.

Paying members of the family who do not work in the family firm may boost the notion that you have to be family member privilege – an expectation of guaranteed rights to business benefits. Non-family employees and family members who work in the business are always apprehensive of any interest provided to family members who do not work. Their concerns are well-grounded. Paying for school expenses, cars, health insurance, as well as payroll agreed to by parents for their children who do not work in the business are practices that do not often come with an expiration date.

Of course, as with everything related to taxes, there are special rules, exceptions, and rules that govern every possible situation. If you have questions about hiring family members or other tax or payroll issues, contact AccuServe Payroll for more information.

Paying family members on your payroll, what you should know!

hiring family members in a...

Read MoreWhat is FUTA? Federal Unemployment Tax Rates and Information for 2022

The Federal Unemployment Tax Act...

Read More2024 Payroll Calendar Guide: Creating Hassle-Free Schedules

hiring family members in a...

Read More

![1099 Vs. W2 [The Differences Between Independent Contractors and Employees]](https://www.accuservepayroll.com/wp-content/uploads/2020/05/Content_link-1.png)