What is FUTA? Federal Unemployment Tax Rates and Information for 2021

What is FUTA? Federal Unemployment Tax Rates and Information for 2022

Read a Quick Summary of this page

Pay employees $1,500 or more in salary in a calendar quarter? You must then pay this tax every year after that.

What is FUTA?

The Federal Unemployment Tax Act (FUTA) established a scheme to assist states in paying for unemployment compensation for laid-off workers (other than for gross misconduct). This tax must be paid annually if you pay employees $1,500 or more in wages. This fee is in addition to any state unemployment insurance that you may be obligated to pay.

Basics of FUTA

The Federal Unemployment Tax Act (FUTA) is a tax that employers pay to the federal government. Employees are not required to pay the FUTA tax or have it deducted from their paychecks. Only the first $7,000 of each employee’s pay is subject to the tax (other than wages that are exempt from FUTA). This pay ceiling has been in place since 1983, but Congress may adjust it in the future.

Self-employed people do not have to pay the FUTA tax. As a result, there is no FUTA on your distributive share of partnership income if you are a partner. You do not have to pay FUTA on payments to independent contractors if you use them in your business.

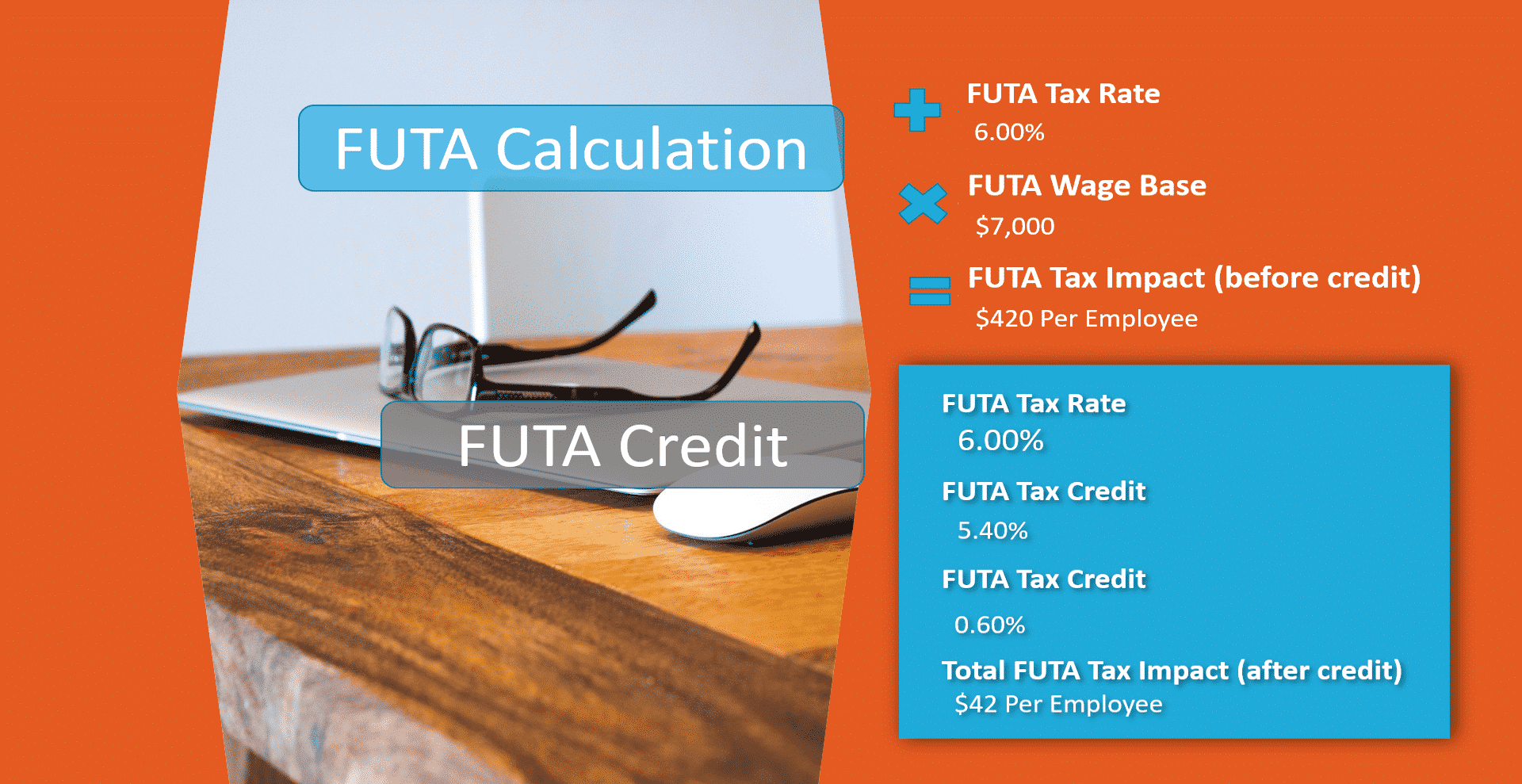

The FUTA rate is 6% in its most basic form. However, you may be eligible for a 5.4 percent state unemployment tax credit. This lowers the federal net tax rate to 0.6 percent. Applying this rate to each employee’s first $7,000 in wages results in a tax of up to $42 per employee. A 0.2 percent surtax had been in place since 1983, but it was finally repealed in 2007 after repeated delays.

Note: A state may be considered a “credit reduction state” if it has not repaid federal borrowing to satisfy its unemployment benefits liability. As a result, the amount of the state unemployment tax credit is lowered, while the FUTA rate is effectively raised. The Department of Labor is in charge of designating credit reduction states.

Benefits of Outsourcing Payroll

Discrepancies between FUTA and FICA

FICA should be separated from FUTA, a distinct tax paid by employers and employees to cover Social Security and Medicare benefits. The Social Security element of the FICA tax is 6.2 percent of taxable compensation up to a predetermined sum annually (e.g., $137,700 in 2020), and the Medicare portion is 1.45 percent of taxable salary (without any limit).

Both the employer and the employee pay the same amount. The employer’s FICA tax, for example, is $3,825 (6.2 percent of $50,000 + 1.45 percent of $50,000) if an employee makes $50,000. The employee is responsible for the same $3,825, which is deducted from their compensation.

Key Takeaways

• The Federal Unemployment Tax Act (FUTA) imposes a payroll tax on all businesses with employees, going to fund unemployment compensation.

• The FUTA tax rate will be 6% of the first $7,000 paid to each employee annually beginning in 2021.

• Even though the FUTA payroll tax is based on employees' wages, it is only imposed on employers, not employees.

• Employers who additionally pay state unemployment insurance may be eligible for a federal tax credit of up to 5.4 percent, resulting in a 0.6 percent effective FUTA tax rate.

Paying and reporting FUTA

Even though FUTA requires annual reporting (see below), it must be deposited at least quarterly if the tax is more than $500 per quarter.

If your FUTA tax burden for the calendar year is more than $500, you must make at least one quarterly payment. If your FUTA tax liability is less than $500 in a given quarter, carry it forward to the next quarter and so on until your total FUTA tax liability exceeds $500. At that time, you must deposit your FUTA tax for the quarter.

The Electronic Federal Tax Payment System is used to make deposits (EFTPS). If you don’t get over the $500 threshold, you can pay the tax when you complete your yearly FUTA tax return.

Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, is used to report the tax. If any of the following apply, you must file a return:

- In any calendar quarter during the current or preceding year, you paid employees $1,500 or more in wages.

- In any 20 or more separate weeks in the current or preceding year, you had one or more employees for at least some part of a day.

Employers of agricultural employees are subject to special rules. They’re in the Form 943 Instructions.

By January 31 of year after year in question, Form 940 must be filed (e.g., January 31, 2020, 2019).

Returns can be sent or electronically-filed (the IRS has a list of authorized providers here). A tax professional can assist you if you are unsure how to calculate, file, or meet your FUTA responsibilities.

What is the FUTA Tax Rate for 2022?

The FUTA tax rate has remained steady so far in 2021. Employers should withhold 6% of an employee’s first $7,000 in salary, as they have in previous years. The state unemployment tax (SUI) credit of up to 5.4 percent remains constant.

A corporation must continue to withhold FUTA if it pays $1,500 or more in salaries in any calendar quarter in 2019 or 2020, 2021, or pays employees for at least a portion of a day in any 20 weeks in 2019 2020. Separate tests are administered to agricultural workers and domestic workers.

The CARES Act recently extended the deadline for paying the employer’s part of Social Security taxes until 2020, but the FUTA deadlines have not altered. The next due date for federal unemployment tax payments is July 31st. FUTA withheld in the second quarter of 2020 that exceeds $500 must be deposited at this time.

The CARES Act also includes an Employee Retention Credit to help businesses keep paying wages to employees who cannot work due to the pandemic. This credit will be applied first to any unpaid Social Security taxes. Employers will be repaid any unused credit

Fast Facts

Employers are required by the Federal Unemployment Tax Act to file IRS Form 940 each year to report the payment of their FUTA taxes. In most cases, IRS Form 940 must be filed in the first quarter of the year.

Who pays for unemployment insurance?

Unemployment insurance is paid for by employers through federal and state payroll taxes. The federal tax is known as FUTA (Federal Unemployment Tax Act), whereas the state tax is known as SUTA (State Unemployment Tax Act) (State Unemployment Tax Act). These are the taxes:

- Collected when an employee is hired and terminated; and

- displayed on your employees’ pay stubs each payday.

However, be aware that several states have their interpretation of the law about which employers must pay unemployment insurance taxes. To find out the specific guidelines that apply to your circumstance, go to your state’s Department of Labor website.

Does my business need to pay unemployment insurance taxes?

If your business meets the following criteria, you must pay both federal and state unemployment insurance taxes:

- Employees were paid $1,500 or more in pay in any quarter of a calendar year; or

- For 20 or more weeks in a calendar year, you had at least one employee on any given day. These weeks don’t have to be in any particular order.

Self-Employed

What happens if you work for yourself? Do you have to pay the FUTA tax? The quick answer is that if you’re self-employed, you’re not required to pay FUTA. You, on the other hand, are not eligible for unemployment benefits.

FUTA is only a small portion of the payroll tax journey for a small business. Check out {atrical} tutorial here if you want to learn more about the full procedure. If you ever have any questions or wish to delegate this task from your to-do list to someone else, we make payroll simple. Have a look.