Custom Payroll Calendar

Experiance has shown, it is always nice to have a Payroll Calendar or Pay Schedule on hand when processing your payroll. To help with that AccuServe Payroll is happy to provide a free customized payroll calendar*. Create a custom payroll calendar by following the instruction below.

The payroll calendar will be created based on the criteria that you enter.

You will be asked a few question in order to create the correct pay schedule. Enter your pay schedule below based on these common payroll schedules. (biweekly pay schedule, semi monthly pay schedule, monthly pay schedule)

Please select the payroll calendar you would like to create

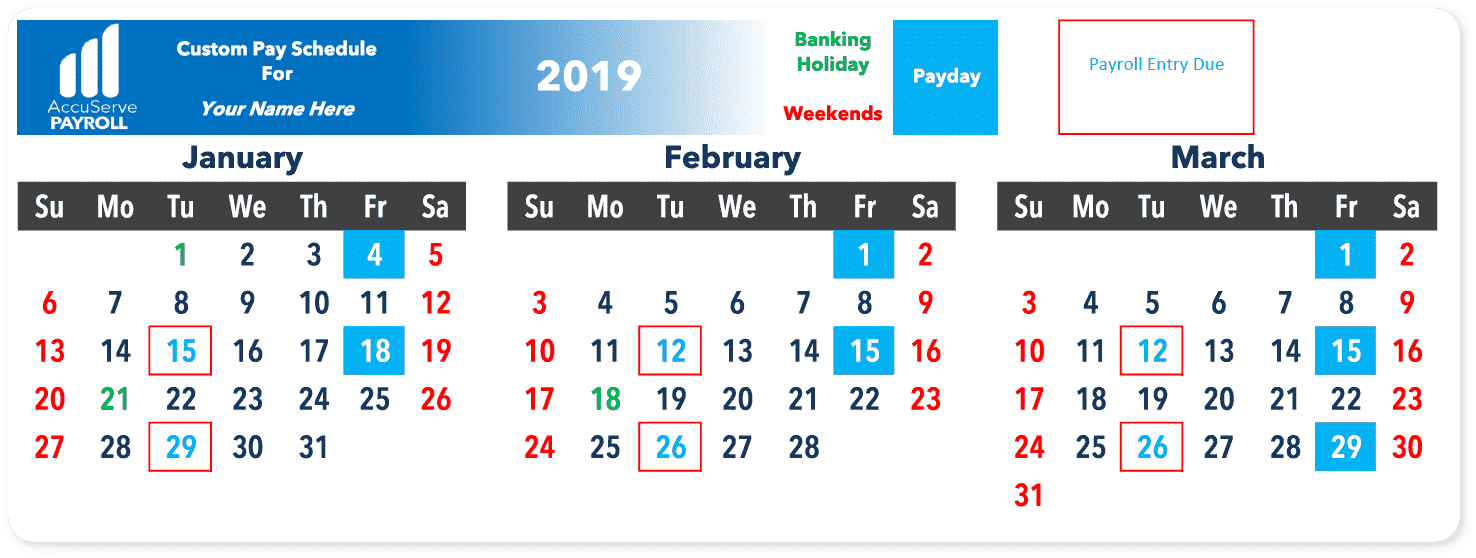

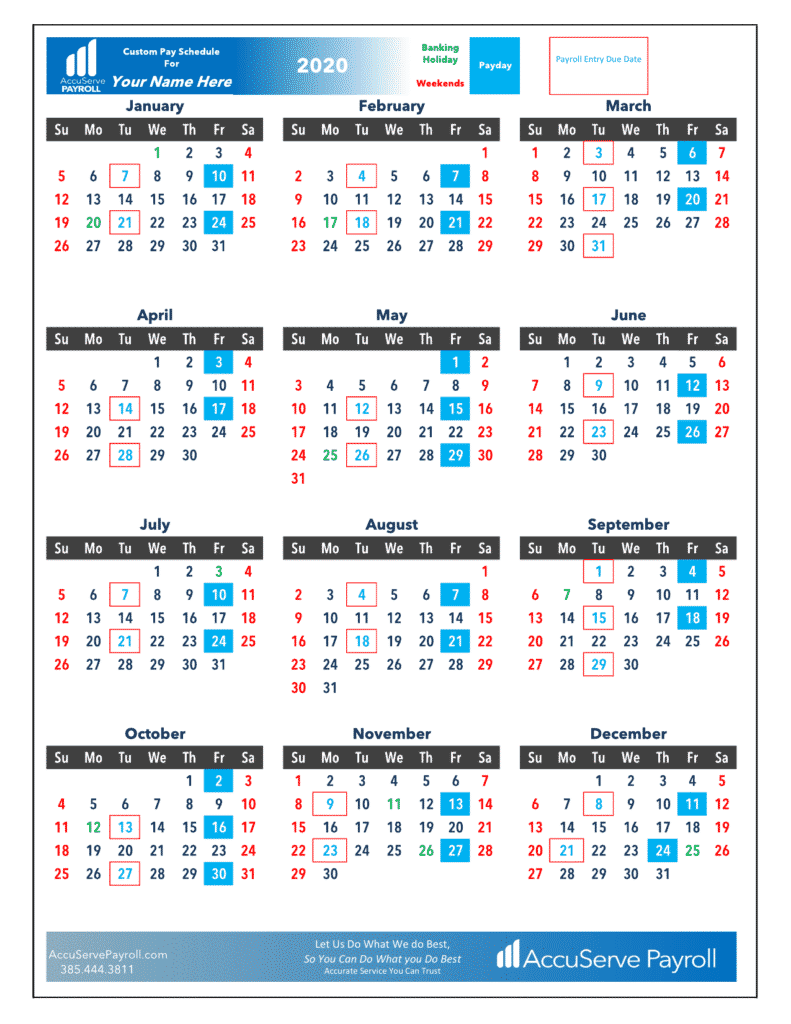

Your Payroll Calendar will look like this

Download the App to Create Your Calendar

Our custom payroll calendar is designed to create schedules designed by organizations to manage payroll efficiently.

It outlines pay periods, processing dates, and employee paydays, ensuring a timely and accurate understanding.

Click Here

Creating Calendars

Custom Calenders

Creating custom payroll calendars involves tailoring the payroll schedule to meet the specific needs of your organization. Payroll calendars generation typically include important dates related to payroll processing, such as pay periods, pay dates, tax deadlines, and other relevant financial events. Here are the steps to create custom payroll calendars:

Gather Information:

Start by gathering all the necessary information that will influence your payroll calendar. This includes your company’s fiscal year, your pay frequency (e.g., weekly, bi-weekly, semi-monthly, or monthly), and any legal or industry-specific requirements that affect payroll, such as tax filing deadlines or union agreements.

Determine Payroll Periods:

Decide on the pay periods that make the most sense for your organization. Common pay periods include weekly (52 times a year), bi-weekly (26 times a year), semi-monthly (24 times a year), or monthly (12 times a year). Consider factors like employee preferences and budget constraints when making this decision.

Set Payroll Processing Dates:

Determine the specific dates on which you’ll process payroll for each pay period. These dates should account for weekends, holidays, and any internal processing time needed to calculate and distribute paychecks or direct deposits.

Establish Pay Dates:

Define the dates on which employees will receive their paychecks or direct deposits. Ensure that these dates comply with labor laws and employee contracts. Common pay dates include the 15th and last day of the month, or the first and last Friday of each month, depending on your chosen pay frequency.

Communicate the Calendar:

Once your custom payroll calendar is established, communicate it clearly to all relevant employees and departments, including HR, finance, and payroll personnel. Make sure everyone understands the schedule and its implications for budgeting and financial planning.

Monitor and Adjust:

Periodically review and adjust your custom payroll calendar as needed. Changes may be necessary due to evolving business needs, regulatory updates, or changes in employee contracts.

Use Payroll Software:

Consider using payroll software or outsourcing payroll services to help manage the complexity of payroll processing and ensure accuracy in calculations and compliance with tax regulations Get a Quote.

Remember that creating a custom payroll calendar requires careful planning and consideration of legal and organizational factors. It’s essential to stay informed about changes in labor laws and tax regulations that may impact your payroll schedule.

In addition to creating a payroll calendar. It is important to create the correct payroll calendar for your company. The below link will connect you to those resources