NEW EMPLOYER INFORMATION BY STATE FOR PAYROLL

NEW EMPLOYER INFORMATION BY STATE FOR PAYROLL

Payroll is not a generic across the board for small business owners. While you understand that your employees must be paid correctly and taxes must be submitted, it’s difficult to take advise from small company owners in other states because payroll rules and regulations differ from state to state. Minimum wage rates, payroll schedules, state reciprocity requirements, and how you manage an employee’s final payment are all examples of elements that differ by state.

We break down the essential items you need to know about small company payroll in your state in the links below, but first, we have some general information that all small business owners in your state should be aware of.

What is a State Tax Identification Number (STIN)?

A state tax ID is essentially a different moniker for your social security number (EIN). An EIN is a tax identification number that you’ll need to pay federal taxes, recruit staff, and apply for company loans. If your small business is required to pay state taxes, a different number may be required. Again, this differs by state, so be sure you know the rules in yours. Again, this differs by state, so be sure you know the rules in yours. The US Small Business Association’s page on state and federal tax IDs is a useful reference.

What is an Unemployment Tax Identification Number?

If you have employees in your small business, you must file for unemployment insurance. The rules for obtaining an unemployment tax ID differ not just by state, but also by type of business, such as for-profit, non-profit, home, agricultural, government, or Indian tribes. Looking at the rules set forth by the US Department of Labor is the greatest resource for knowing the requirements for acquiring an unemployment tax ID in your state.

Is It Necessary to File State Income Taxes?

We’re thinking that tax season isn’t at the top of the list when it comes to favorite seasons. Most business owners should file a state income tax return in addition to their federal income tax return. The income rates range from 0% to over 13%. Yes, you read it correctly — certain states do not have income tax obligations, so check to see if yours does.

The Impact of State Requirements on Payroll

As you can see, following federal rules is difficult enough, but when you add state laws to the mix, things get even more convoluted. Selecting online payroll software to assist you might be a wise selection. AccuServe Payroll, for example, keeps up with all federal, state, and local tax rules to ensure that your small business is always compliant. Some states, such as Pennsylvania, have more complicated tax obligations at the jurisdiction level, and we work hard to assist small businesses with their tax complexity as well.

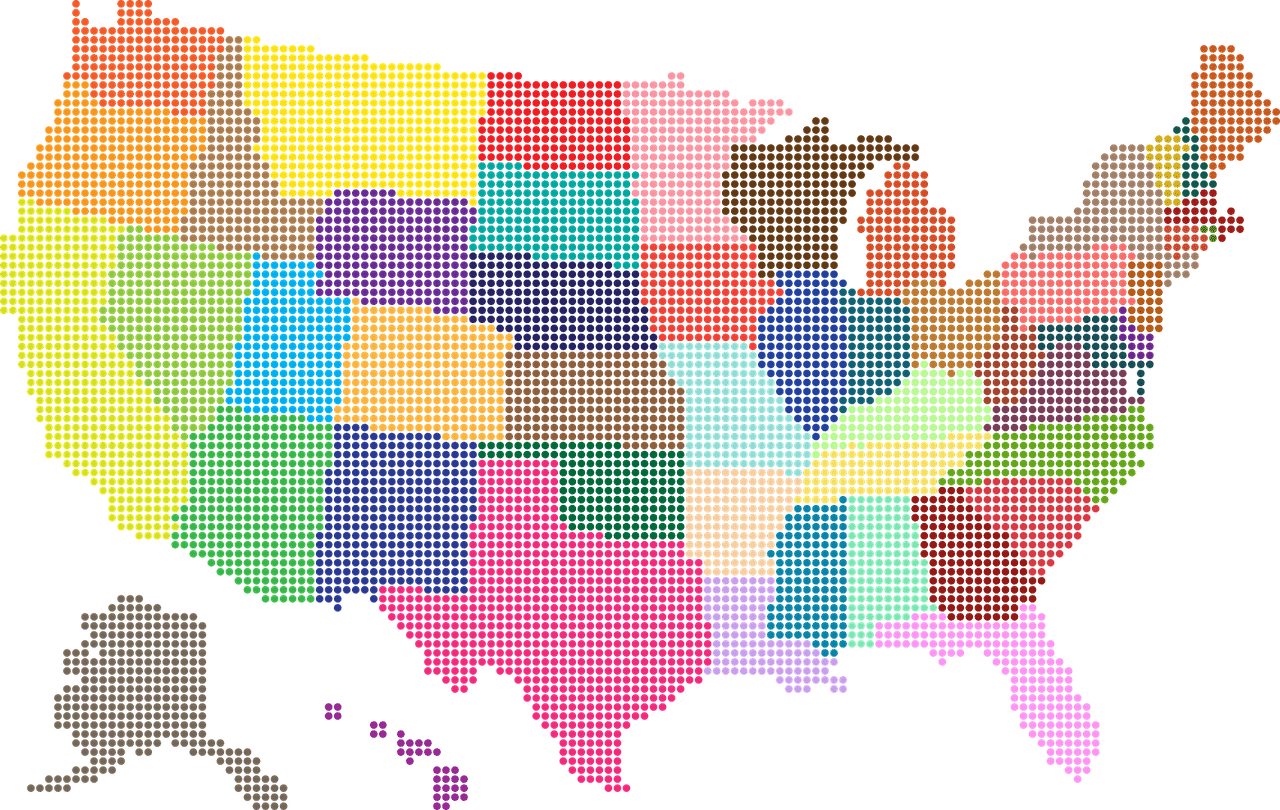

Learn more about the criteria in your state by looking at the table below.